Whitelabel Web App

Enterprise-Grade Cross-Border Payment Platform for Small to Mid-Sized MTOs

Product Overview

Built for Small to Mid-Sized MTOs

Whitelabel Web App is an enterprise-grade cross-border payment platform designed specifically for small to mid-sized Money Transfer Operators (MTOs). We help MTOs quickly build a payment service platform for their business clients, providing comprehensive cross-border collection and payout solutions.

What is Whitelabel Web App?

Whitelabel Web App is a complete white-label payment solution that enables MTOs to offer professional cross-border payment services under their own brand to business clients. No need to start from scratch—you can quickly deploy a fully-featured, compliant, and secure payment platform.

Supported Business Scenarios

B2C Scenarios

Business to consumer payments, such as e-commerce refunds to overseas users, commission payouts, etc.

B2B Scenarios

Business-to-business cross-border payments, such as supplier payments, international trade settlements, cross-border procurement, etc.

C2B Scenarios

Consumer to business payments, such as cross-border e-commerce shopping, international service subscriptions, tuition payments, etc.

Core Features

Cross-Border Collection

- •Multi-Channel Collection: Support for bank transfers, international card payments, local payment methods, etc.

- •Real-Time Settlement: Fast fund settlement to improve customer experience

- •Auto Reconciliation: System automatically matches transaction records, simplifying financial processes

Cross-Border Payout

- •Batch Payments: Support for bulk payout operations to improve efficiency

- •Multi-Currency Payments: Support local payments in 50+ currencies

- •Payment Tracking: Real-time payment status and logistics tracking

Currency Exchange

- •Real-Time Rates: Access to authoritative exchange rate sources with real-time updates

- •Preferential Rates: More favorable rates for bulk transactions

- •Rate Lock: Support for rate locking to hedge against exchange rate risks

Customer Management

- •KYC/KYB Verification: Complete customer identity verification process

- •Risk Rating: Automatic risk assessment and tiered management

- •Customer Grouping: Flexible customer grouping and permission management

Data Reports

- •Transaction Reports: Detailed transaction records and analysis

- •Financial Reports: Income, expenses, fees and other financial data

- •Compliance Reports: Various reports meeting regulatory requirements

Security & Compliance

- •Data Encryption: Bank-grade 256-bit SSL encryption

- •Anti-Fraud: Real-time transaction monitoring and risk alerts

- •Compliance Certification: Compliant with international payment standards

Smart Routing - Core Competitive Advantage

What Makes Us Different?

Compared to other Whitelabel products on the market, our biggest advantage is the Smart Routing Strategy Engine. We not only provide a payment platform but also an intelligent PSP (Payment Service Provider) selection and management system.

How Does Smart Routing Work?

Our smart routing system can automatically select the optimal PSP channel for each transaction based on preset rules and real-time data. This not only improves payment success rates but also significantly reduces transaction costs.

Multi-Dimensional Routing Strategy

- •Geographic Routing: Automatically select optimal channel based on origin and destination

- •Cost Optimization: Choose the lowest-fee available channel

- •Success Rate Routing: Prioritize channels with high success rates

- •Speed Priority: Select the fastest settlement method

Flexible Configuration Rules

- •Custom Priority: Set usage priority for different PSPs

- •Amount Range Rules: Select different channels based on transaction amount

- •Time-Based Rules: Use different strategies at different times

- •Customer Tier Routing: VIP customers use dedicated premium channels

Intelligent Failover

- •Auto Retry: Failed transactions automatically try backup channels

- •Real-Time Monitoring: Monitor PSP status and switch in time

- •Load Balancing: Distribute transaction load to improve stability

- •Degradation Strategy: Automatically activate backup plan when PSP fails

Data-Driven Optimization

- •Real-Time Analysis: Analyze performance of each PSP

- •Cost Tracking: Track actual cost of each channel

- •A/B Testing: Test effectiveness of different routing strategies

- •Smart Recommendations: System automatically recommends optimal routing strategy

Smart Routing Value

| Comparison | Traditional Single PSP | Whitelabel Web App |

|---|---|---|

| Success Rate | 85-90% | 95-98% |

| Transaction Cost | Fixed rate | Save 15-30% |

| System Availability | Single point of failure risk | 99.9% high availability |

| Coverage | Limited | 100+ countries full coverage |

| Optimization | Manual adjustment | AI auto-optimization |

Real Case Study

After a mid-sized MTO used our smart routing, payment success rates increased from 87% to 96% by automatically selecting optimal channels, saving over $50,000 per month in transaction costs, while reducing average settlement time by 40%.

Product Advantages

Key Advantages

Quick Launch

Complete white-label solution with pre-integrated PSPs ready to use. No need to manually integrate multiple payment providers or start from scratch - go live in 4-8 weeks instead of 6-12 months.

Global Coverage

Support 100+ countries and regions, 50+ currencies, true global payment solution

Smart Routing

Proprietary smart routing technology, automatically select optimal PSP, reduce costs and increase efficiency

Multi-Platform

Support Web, iOS, Android, H5 and all platforms

UI Showcase

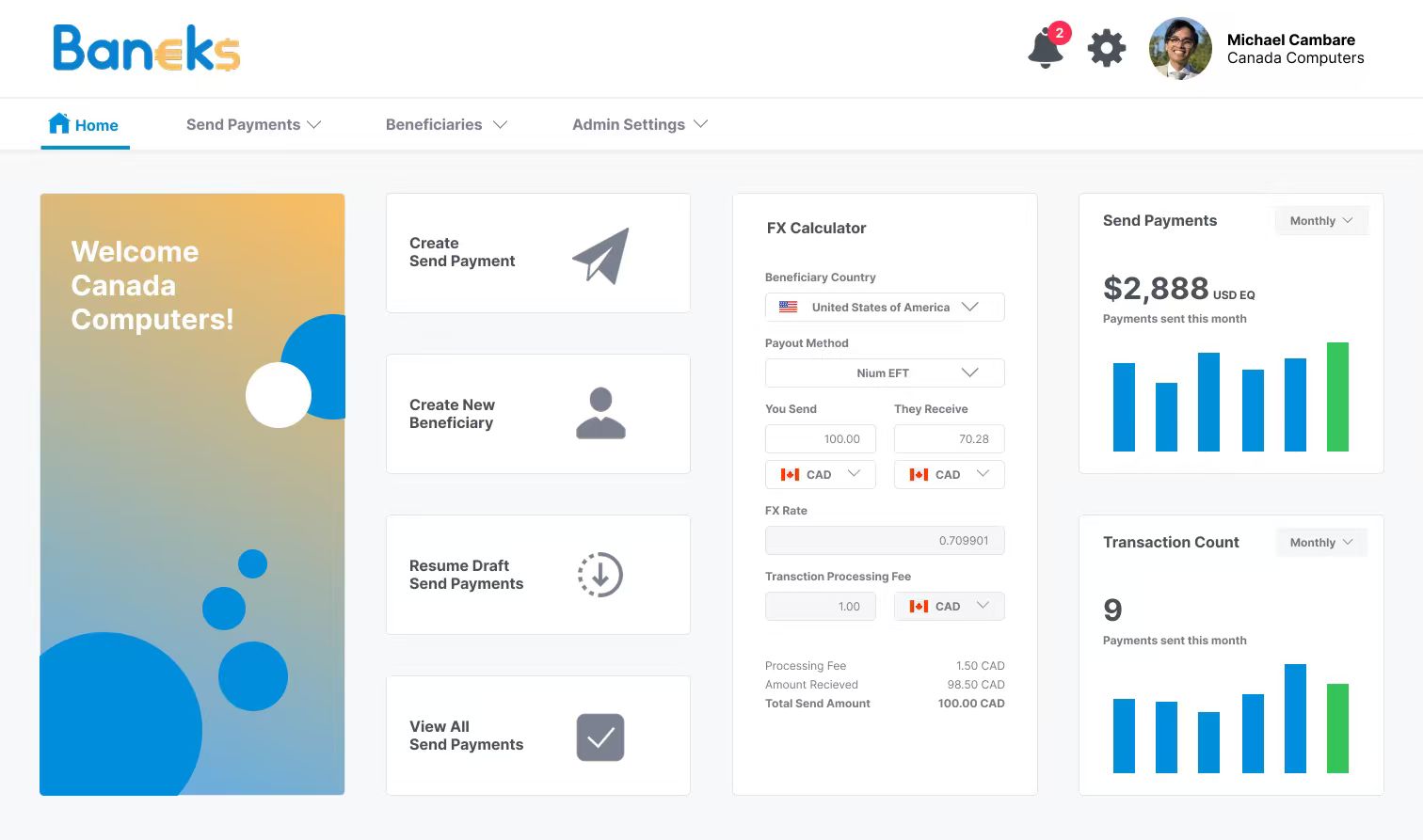

Modern Management Interface

Intuitive and easy-to-use dashboard, enabling your business clients to easily manage cross-border payment operations

Key Features

- •Quick Payment Creation: One-click cross-border payment orders, supporting B2C, B2B, C2B scenarios

- •Real-Time FX Calculator: Built-in real-time forex calculator, 50+ currencies, real-time rate updates

- •Data Visualization: Intuitive charts showing payment trends and transaction volume statistics

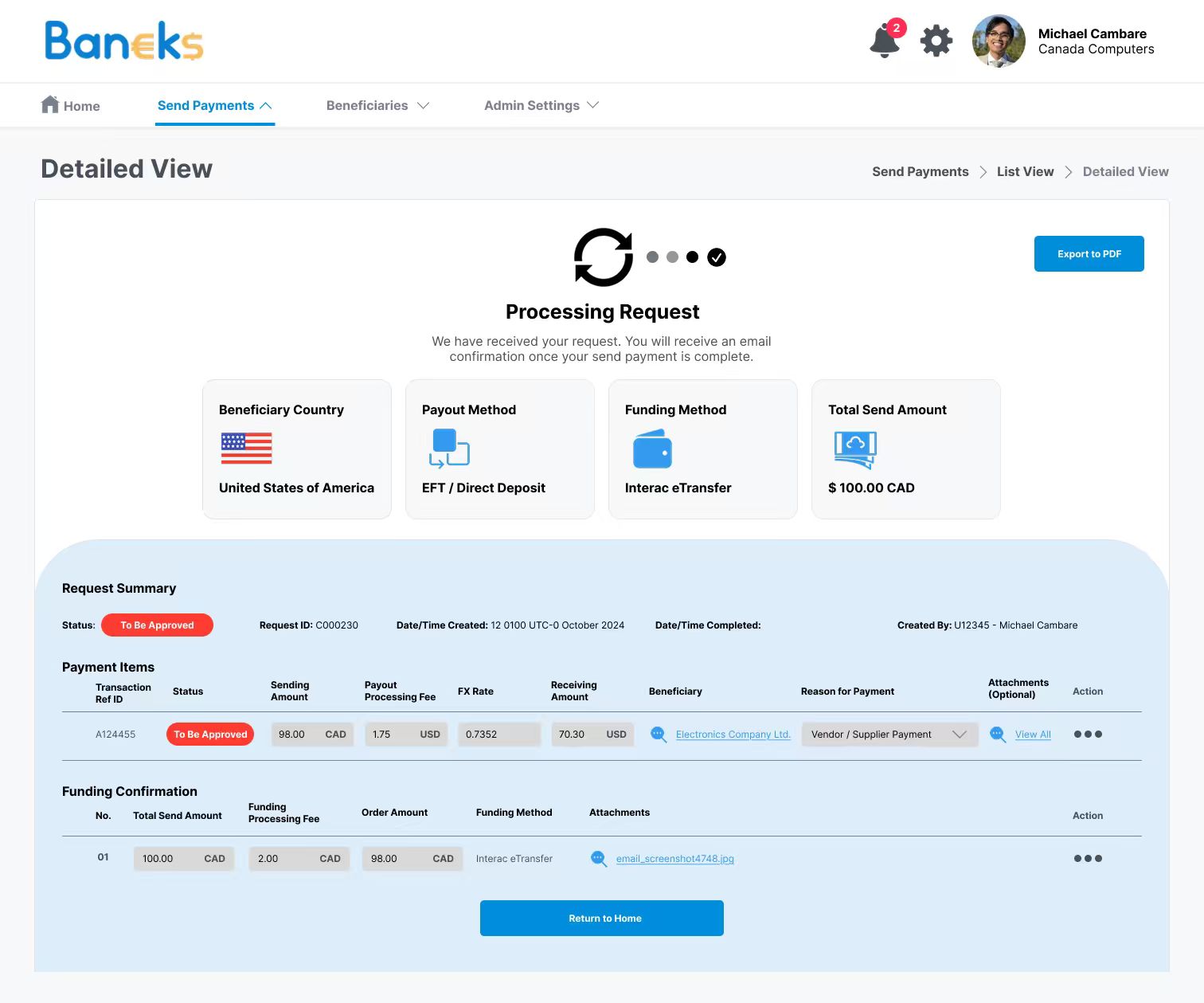

Complete Payment Processing Flow

From creation to completion, every step is clear and visible, giving customers peace of mind

Key Features

- Multiple Payment Methods: EFT, Wire Transfer, ACH and more, meeting different customer needs

- Detailed Records: Complete transaction information records, support export to PDF and Excel

- Approval Process: Configurable multi-level approval to ensure fund security and compliance

Ready to Get Started?

Join us and let smart routing empower your payment business